Mortgage interest rates keep on dropping!

On February 27, 2020, Freddie Mac stated,

“Mortgage rates change frequently. Over the last 45 years, they have ranged from a high of 18.63% (1981) to a low of 3.31% (2012). While it’s not likely that the average 30-year fixed mortgage rate will return to its record low, the current average rate of 3.45% is pretty close— all to your advantage.”

Just days later, the rates did, in fact, drop again – in some cases as low as 2.9%!

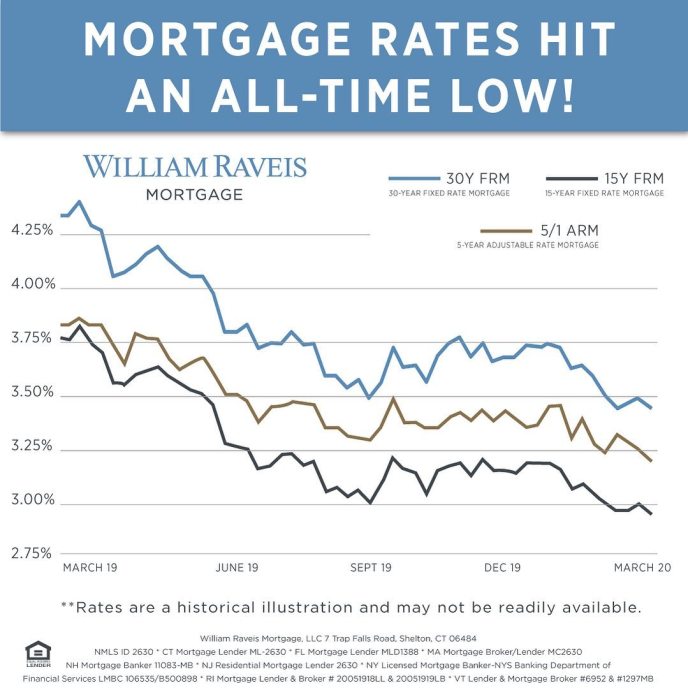

Whether you are buying a home, already a homeowner, or getting ready to sell, it’s crucial to pay attention to mortgage interest rates. Take a look at mortgage rates from March 2019 to March 2020.

What do low rates mean for buyers?

The lower the interest rate on a mortgage, the less you have to pay back. Buyers who are currently in the market for a new home have the opportunity to save on monthly payments. In the chart below, you can see how much the monthly payment drops with lower interest rates.

How Interest Rates Impact Monthly Housing Payments

| 1970s | 1980s | 1990s | 2000s | 2010s | Today | |

| Average Rate | 8.86% | 12.70% | 8.12% | 6.29% | 3.99% | 3.2% |

| Approximate Monthly Payment | $1,589 | $2,166 | $1,484 | $1,237 | $954 | $865 |

*These numbers reflect principal and interest only, based on a $200,000, 30-year mortgage.

Low rates also allow buyers to buy more house. For example, let’s say potential buyers are qualified for a monthly loan payment of $1,200. With a mortgage rate of 3%, buyers could afford a home close to $300,000, as compared to a $200,000 home with a rate of 6%.

As a buyer, you can decide – do you want to take advantage of the low rates to save money month to month, or to buy a house at a higher value?

What does it mean for sellers?

Along with low-interest rates, buyer demand is high, while inventory remains low. That adds up to one thing: now is the time to sell!

What if I want to stay in my current home?

If your current mortgage interest rates are 4% or higher, talk with your mortgage lender about refinancing options. If you plan on staying in your home, refinancing to a lower rate could save you a significant amount over the years. Refinancing does require closing costs, so factor that in to your decision.

Whether you are buying, selling, or refinancing, keep in mind that there is an influx of activity in the mortgage industry. Brian Faye, of New England Home Mortgage, said,

“Turn times will increase a little bit. There are only so many appraisers out there, so many underwriters, and now there’s going to be a refinance boom.”

The sooner you begin the process of buying, selling, or refinancing, the better opportunity you have to take advantage of historic rates.